Money : A very important parts of life

Table of Contents

INTRODUCTION

In this post we will see the dark and light(effects and causes) part of the money .Money ! this is the only word which everyone wants in the real world. every person are eagerly searching for money. some of them doing business , some of them are working as employee , some of them are earning through wrong way , some of them borrowing money from other person or bank to fulfil their need. there would be many question regarding money , how do we get money , from where i get money , what i do for money?, how do i become rich within a single night , within a month , within a year? all these type of question is arising in all person’s mind. because now a days money have that kind of value. money means everything , even life can be purchased by money like buying kidney , eye , heart etc that things gave life to that person who have money and they need it, and even a person can be purchased by money. just a few things are which can’t be bought from money which is virtue and grief. even a person can buy happiness from money. but there can be grief for the money. money divides the person , money categories the person , money creates the discrimination , money creates value , money creates the power ,money creates respects . in a single word money is “EVERYTHINGS”. In other word we call money as “PROPERTY” . and now a days property is the reason of tribulation* in the family , in the society , even in between the country also it happen. so we will see the more detailed about money in this post.

HISTORICAL EVOLUTION OF MONEY ?

The historical evolution of money is a fascinating journey that begins with the earliest forms of trade and continues to evolve into the digital age. This journey encompasses various stages, including the barter system, the use of commodity money, the introduction of coins, the development of paper money, and the emergence of digital currencies.

1. Barter System: The earliest form of trade was barter, where goods and services were exchanged directly without a common medium of exchange. This system had limitations, as it required a “double coincidence of wants,” meaning both parties had to want what the other had to offer like one people want 1 L oil and they have 1 kg of wheat on the hand other person need 1 kg wheat and they have 1 L oil in this both of them exchange their goods and this is called barter system and when both person have different need in that they can’t exchange their goods so , here barter system are not applicable and people need to search for a other person who need the goods they have that’s why Barter was inefficient and impractical, especially as trade networks expanded and people’s needs became more diverse.

2. Commodity Money: To overcome the limitations of barter, societies began using commodity money, where a tangible good with intrinsic value, such as gold, silver, or other precious metals, was used as a medium of exchange.in this system if you need any kind of goods you can buy it with the help of by paying gold , silver or other metal as exchange medium. These commodities were valued for their scarcity, durability, divisibility, and portability. Commodity money provided a common measure of value and facilitated trade, but it also had limitations, including the risk of theft and the need for constant verification of purity. and many people can’t pay this too.

3. Coins: The next major development in the evolution of money was the introduction of coins. Coins were standardized units of metal (usually gold or silver) that were minted by governments or ruling authorities. Coins provided a more convenient and portable form of currency compared to bulkier commodities like gold bars. Coins also helped to standardize trade and establish a system of currency denominations. that’s why now a days its easy to fulfil our need by just changing our money to the required amount of goods like if the 1 kg rice cost is Rs 50 then you need to pay 50 rupee for 1 kg of rice and multiple if we need more amount of rice. Different country have different currency and in this we will learn many currencies and its value with respect to Indian rupees .

4. Paper Money: The use of paper money as a medium of exchange emerged in medieval China during the Tang Dynasty (618-907 AD). Merchants and traders began using paper receipts as a convenient and portable alternative to carrying large amounts of coins. paper money was more easier to use because it was light in weight and it does not produce sound .Paper money gradually spread to other parts of the world, including Europe and the Islamic world. Governments began issuing paper money as legal tender, backed by the promise of redemption in precious metals. There was a problem associated with paper money , paper money gets tears after few days so people need to be very careful for using this money type. it makes the use of money very easy and easy in portable and there is no fear of theft. and we can send money to large distance within a second without having any physical touch. and we can use this method every time like 24 hours . this method is directly linked to bank. in Indian there are lots of digital method like google pay , phone pay , Paytm and so on . it helps in ecommerce like amazon flip kart etc.

5. Fiat Currency: In modern times, most countries have transitioned to fiat currency, which is money that is not backed by a physical commodity but derives its value from the trust and confidence people have in the issuing authority, typically a government or central bank. Fiat currency is used for most transactions and is the primary form of currency in the global economy. Fiat currency is represented in both physical forms, such as banknotes and coins, and digital forms, such as electronic funds in bank accounts.

6. Digital Currencies: The most recent development in the evolution of money is the emergence of digital currencies, such as Bitcoin and other cryptocurrencies. Digital currencies use cryptographic algorithms for security and are not tied to any physical asset. Instead, they are created and managed using decentralized networks of computers. Digital currencies offer advantages such as fast and low-cost transactions, global accessibility, and increased privacy. However, they also pose challenges, including regulatory concerns and volatility.

In short we can that , the historical evolution of money is a testament to human ingenuity and innovation. From the barter system to commodity money to coins to paper money to fiat currency to digital currencies, money has undergone significant transformations over time. As economies continue to evolve, it is likely that the concept of money will also continue to evolve, reflecting changing economic and technological landscapes.

WHAT IS MONEY?

Money is a medium of exchange that is commonly used to facilitate transactions. It can take various forms, including cash (coins and banknotes), digital currency (such as cryptocurrencies), and electronic money (like bank deposits and payment cards). Money serves several important functions in an economy:The concept of money has evolved over time. Initially, it was based on tangible assets like precious metals (e.g., gold and silver) or other commodities with intrinsic value. Over time, governments and central banks introduced fiat money, which has value because the government says it does, and people trust that it will be accepted as a medium of exchange. More recently, digital currencies like Bitcoin have emerged, which rely on cryptographic algorithms for security and are not tied to any physical asset.

In shorts, money is a fundamental aspect of modern economies, serving as a medium of exchange, a unit of account, a store of value, and a standard for deferred payment. Its nature and form have evolved over time, reflecting changes in economic systems, technology, and societal needs.

IMPORTANCE OF MONEY IN ECONOMY !

Money plays a critical role in modern economies, serving various functions that contribute to the smooth functioning of markets and the overall health of the economy. These functions are crucial for facilitating transactions, measuring value, storing wealth, and enabling economic growth. Here are the key ways in which money serves as a critical component of the economic system:

Medium of Exchange: Money serves as a medium of exchange, allowing people to trade goods and services without the need for barter. This function is foundational to market economies as it enables specialization and division of labor. Without money, individuals would need to find someone with the exact goods or services they need who also desires the goods or services they have to offer, which is often impractical or impossible.

Unit of Account: Money provides a common measure of the value of goods and services. Rather than having to express the value of items in terms of other items (e.g., saying a cow is worth 3 chickens), money provides a universally recognized unit of measurement. This standardization simplifies economic transactions and makes it easier to compare the relative value of different goods and services.

Store of Value: Money can be stored and saved for future use. Unlike perishable goods or assets, money can be held over time and used when needed without significant loss of value. This function allows individuals and businesses to build wealth, plan for the future, and navigate economic uncertainties.

Standard of Deferred Payment: Money enables transactions to be made at a later date. This is crucial for credit transactions and the economy’s ability to function over time. For example, when a consumer takes out a loan to buy a house, they agree to repay the loan in the future with money that retains its value.

Measure and Standard for Prices: Money provides a common denominator for expressing prices and evaluating the relative value of goods and services. Prices are expressed in terms of a monetary unit, such as dollars or euros, which allows consumers and businesses to compare the cost of different goods and services and make informed purchasing decisions.

Means of Exchange in Financial Markets: Money serves as a means of exchange in financial markets, where it is used to buy and sell financial instruments such as stocks, bonds, and derivatives. Financial markets play a crucial role in allocating capital efficiently and facilitating investment, which is essential for economic growth.

Medium of Record: Money is used as a medium of record, providing a historical record of economic transactions. This function is crucial for tracking the flow of goods, services, and resources in the economy and for maintaining transparent and efficient financial systems.

money serves several essential functions in an economy, facilitating transactions, measuring value, storing wealth, and enabling economic growth. These functions are foundational to the operation of market economies and are essential for promoting efficiency, innovation, and economic development.

INDIAN CURRENCY VALUE WITH RESPECT TO OTHER COUNTRY'S CURRENCY !

We are providing list of all currencies of all countries, along with their exchange rates relative to the Indian currency, is not feasible due to the large number of currencies and the constant fluctuations in exchange rates. However, I can provide some information on a few widely recognized and commonly traded currencies, along with their exchange rates in terms of the Indian Rupee (INR) as of my last update:

United States Dollar (USD): As of February 2024 , 1 USD is approximately equal to 83- 84 INR.

Euro (EUR): As of February 2024, 1 EUR is approximately equal to 87-88 INR.

British Pound Sterling (GBP): As of February 2024, 1 GBP is approximately equal to 100-105 INR.

Japanese Yen (JPY): As of February 2024, 1 JPY is approximately equal to 0.55-0.56 INR.

Canadian Dollar (CAD): As of February 2024, 1 CAD is approximately equal to 61-62 INR.

Australian Dollar (AUD): As of February 2024, 1 AUD is approximately equal to 54-55 INR.

Swiss Franc (CHF): As of February 2024, 1 CHF is approximately equal to 94-94 INR.

Singapore Dollar (SGD): As of February 2024, 1 SGD is approximately equal to 61-62 INR.

HOW TO EARN MONEY ? SOME POSSIBLE WAY

Earning more money can be approached in various ways, depending on an individual’s skills, resources, and goals. Here are some possible ways to earn money :

Education and Skill Development: Invest in education and skill development to enhance job prospects and increase earning potential. This could include pursuing advanced degrees, certifications, or specialized training in high-demand fields. like you can start your start up like enhance communication skills , computer skills etc . there are of skill field you can start that and earn money .

Career Advancement: Seek opportunities for career advancement within your current organization or through job changes. Moving up the career ladder often comes with higher salaries and additional benefits. now a days there are lots of career field in which you get job according to your talent and skills

Side Hustles and Part-time Work: Explore opportunities for side hustles or part-time work to supplement your main income. This could involve freelance work, consulting, tutoring, or starting a small business. there are many company who is providing the part time work like network marketing work , online form filling work and so on.

Investment Income: Consider investing in assets that generate passive income, such as stocks, bonds, real estate, or mutual funds. Investment income can provide a source of additional earnings over time. now a days many people are investing money on share market , if you have any other income source then you can invest your money here and increase your income and become very rich within very short time of period. note : this field is very risky so be very careful and enters in it only after if you have knowledge.

Entrepreneurship: Start your own business or venture. Entrepreneurship offers the potential for significant financial rewards but also involves risk and hard work. if you have innovative idea and you want to bring that idea in market then you can take help from investor to take investment on your idea and start your own business , now a days more than 50% people doing their own business.

Monetizing Skills and Hobbies: Find ways to monetize your skills, talents, and hobbies. This could involve selling crafts, offering tutoring services, teaching online courses, or starting a blog or YouTube channel. this is best way to earn money from home , you can start website/blogging too by which you can year money.

Passive Income Streams: Look for opportunities to generate passive income, such as renting out property, creating digital products, or participating in affiliate marketing programs with amazon, flip kart etc. and if you have your own product you can sell them on online.

Networking and Building Relationships: Build a strong network of professional contacts and relationships. Networking can lead to new job opportunities, partnerships, and business ventures. each and every business are working on networking in this way you can rich to maximum number of people and increase the earning source . many of person are doing direct selling which is also a type of networking business.

Continual Learning and Adaptation: Stay informed about industry trends and changes. Be adaptable and willing to learn new skills and technologies that can increase your earning potential. if you have ability to learn anything then you can earn money from that because now a every kind of area is growing so fast.

Negotiation Skills: Develop strong negotiation skills. Negotiating a higher salary or better terms can significantly increase your income.

Financial Literacy: Educate yourself about personal finance and wealth management. Good financial management can help you make better decisions about saving, investing, and spending, leading to increased wealth over time.

Remote Work and Freelancing: Explore opportunities for remote work or freelancing, which can provide flexibility and potentially higher earning potential.

It’s important to note that earning more money often requires hard work, dedication, and sometimes risk-taking. Additionally, focusing solely on earning more money may not lead to long-term financial success. It’s also important to consider factors like work-life balance, personal fulfillment, and financial security.

WHY DO WE NEED MONEY?

Money is a vital aspect of daily life for several reasons:

Basic Needs: Money is necessary to fulfill basic needs like food, shelter, and clothing. It enables individuals to purchase essential items required for daily living.

Education and Healthcare: Money is needed to access education and healthcare services. This allows individuals to gain knowledge and skills and maintain their physical and mental health.

Transportation: Money is required for transportation, whether it’s public transportation fares or the cost of maintaining a personal vehicle. This is essential for commuting to work, school, or other locations.

Utilities and Services: Money is necessary to pay for utilities like electricity, water, and gas. It is also required for services such as phone and internet, which are essential for communication and staying connected.

Recreation and Leisure: Money allows individuals to engage in recreational and leisure activities like dining out, going to movies, and traveling. These activities contribute to mental well-being and overall quality of life.

Savings and Investments: Money is essential for saving and investing, which helps individuals prepare for emergencies, plan for the future, and build wealth over time.

Social and Family Obligations: Money is needed to fulfill social and family obligations like weddings, birthdays, and other celebrations. It also enables individuals to support family members and contribute to their community.

money is essential for meeting basic needs, accessing services, enjoying leisure activities, and planning for the future. It plays a crucial role in individuals’ daily lives, enabling them to live comfortably and pursue their goals and aspirations.

MONEY CATEGORY ON THE BASIS OF SOCIOECONOMIC STATUS

Socioeconomic status is a broad term that encompasses an individual’s or family’s social position based on various factors, including income, education, and occupation. Within this framework, people can be broadly categorized into three main groups: lower-income, middle-income, and higher-income. Here’s a more detailed breakdown of these categories:

Lower-Income: This group typically includes individuals and families who have limited financial resources and may struggle to meet basic needs. They often have lower levels of education and work in low-wage jobs or may be unemployed. They may also face challenges such as inadequate access to healthcare, housing instability, and food insecurity.

Middle-Income: The middle-income group is often considered the middle class. This includes individuals and families with moderate levels of financial resources, often earning a stable income from employment. They typically have completed secondary education or some college and may work in white-collar professions or skilled trades. They may own their homes, have access to healthcare, and enjoy a reasonable standard of living.

Higher-Income: This group comprises individuals and families with significant financial resources and high levels of income. They often hold advanced degrees, work in high-paying professions such as doctors, lawyers, or corporate executives, and may have substantial assets and investments. They enjoy a comfortable lifestyle, have access to high-quality healthcare, education, and housing, and may have opportunities for travel and leisure.

It’s important to note that these categories are not fixed and can vary based on factors such as location, cost of living, and economic conditions. Additionally, people may move between income categories over time due to changes in employment, education, or other factors.

Understanding these divisions based on income is essential for policymakers, social scientists, and others interested in addressing socioeconomic disparities and promoting economic equity

LIST OF RICH PERSON IN THE WORLD

I can mention some well-known individuals who have consistently ranked among the wealthiest people globally.

1. Elon Musk: The CEO of Tesla, SpaceX, Neuralink, and The Boring Company. Elon Musk’s net worth has fluctuated due to stock prices, but he has consistently been among the wealthiest people in the world.

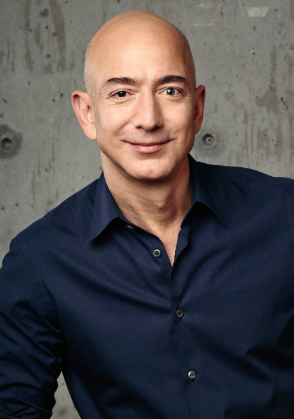

2. Jeff Bezos: The founder of Amazon, Jeff Bezos was the richest person in the world for a significant portion of the past decade. His net worth has also fluctuated due to changes in Amazon’s stock price and other investments.

3. Bernard Arnault & Family: The chairman and CEO of LVMH Moët Hennessy Louis Vuitton, Bernard Arnault has consistently been among the wealthiest individuals globally.

4. Bill Gates: The co-founder of Microsoft, Bill Gates has been a prominent figure among the world’s richest individuals for decades. He has been active in philanthropy through the Bill & Melinda Gates Foundation.

5. Mark Zuckerberg: The co-founder and CEO of Facebook (now Meta Platforms, Inc.), Mark Zuckerberg has been one of the youngest and wealthiest individuals globally, with Facebook’s rapid growth contributing to his net worth.

It’s important to note that the net worth of these individuals can change due to various factors, and rankings may vary depending on the source and methodology used for valuation. Additionally, there are many other individuals globally with significant wealth who may not be as widely recognized

more content visit here related to study

Pingback: Blood Pressure (B.P) :- Symptoms and Controls 2024

Pingback: विज्ञान से आप क्या समझते है : 2024

Pingback: Nationalism : A Comprehensive Analysis

Pingback: भौतिक विज्ञान मे न्यूटन का योगदान : 2024

Pingback: Holi: A Colorful Celebration of Unity and Renewal 2024

Pingback: The Transformative Power of Hard Work: A Comprehensive Exploration powerful